Converting large NBFCs to banks: is it warranted?

Article By

V.P. Nandakumar

MD & CEO of Manappuram Finance Ltd.

An internal working group of the RBI recently suggested that large non-banking financial companies (NBFCs) should convert themselves into Banks. Although reported in the media as a new suggestion, the fact is, conversion of a non-bank to a bank has been allowed since 2016 when RBI announced ‘on-tap’ universal bank licenses. A couple of non-banks did go on to receive the license and became Banks. In effect, the recent discussions do not change the regulatory aspect much for non-banks who are or were willing, to become a bank. However, it may be a precursor to stricter regulation for those large NBFCs who choose not to.

In this context, I am often asked about my stance on this issue, and the consistent answer I give is that given the choice, we would prefer to continue as a non-bank. The rationale is simple. It is the answer to the question, “Should I do something just because I can do that, or should I stick to doing that which I am good at, and which I do best?” There are many reasons why non-banks may find the option of converting into a bank not worth pursuing.

Conversion may not be worthwhile

The first is the high cost of conversion and the need to fulfil extant regulatory requirements from day one. This includes things like maintaining the required investments for SLR (18 per cent) and CRR (3 per cent) which does not apply to NBFCs. As a bank, effectively 21 per cent of the book would earn a return far lower than the average yield on a lending portfolio, in fact, even lower than the borrowing cost. Also, for a gold loan NBFC, meeting the 40 per cent priority sector lending (PSL) norms is a major challenge given that in the current dispensation, gold loans dispensed by NBFCs are specifically excluded from PSL benefits. (Gold loans account for 72 per cent of Manappuram’s total loan portfolio.)

Besides, there is nothing certain about the presumed benefit of conversion, i.e., access to low-cost current and savings account deposits. The cost of deposits need not fall to the expected extent. This is seen in the fact that the cost of deposits for most of the newly minted Banks and Small Finance Finance Banks continues to be well above the industry average.

Once an NBFC becomes a bank, it would necessarily have to diversify the portfolio. This can be disconcerting to NBFCs who have earned their spurs as specialised or niche players, catering to well-defined and narrow segments of the market, with specialised knowledge and skills.

The consequence will be that product innovations will end up taking a back seat. Most product innovations in financial services can be traced back to non-banks. It comes about because they benefit from a light-touch regulatory approach (compared to banks) which gives them the flexibility to experiment with different innovative ideas and work towards their perfection. Be it housing loans, vehicle loans or gold loan, all these products were innovated and scaled up by NBFCs before banks adopted these products. Forcing NBFCs to convert may mean an end to the era of financial innovations. Of course, smaller non-banks would still be able to invest in innovations, but as soon as they reach a defined size, the process of conversion to a bank would kick in, increasing their cost of risk capital.

Converting to a bank would also imply a forced diversification and hence loss of the niche identity created over many years. Non-banks have crafted their business model to suit well-defined target customer segments. There is not one NBFC in India that aims to serve every segment of the market in the way most universal banks do. When compelled to service customers that you are not otherwise equipped to, the impact on the financial system could be negative. For instance, at Manappuram, our niche is gold loans, and our competition is from non-institutional lenders like moneylenders, pawnbrokers, jewellers. To compete against them, we have to be flexible and agile in offering products and services at a low cost, which is not easy for a large and relatively slow-moving banking institution.

Banks provide comprehensive universal banking services to their customers. Most non-banks would lack the required skill-sets, infrastructure or technology to provide such a broad range of services. It would entail huge investments in manpower, infrastructure, and technology which will depress their return on capital. This, in turn, increases the cost of raising further capital, leaving them more vulnerable.

Regulatory arbitrage, the only attraction

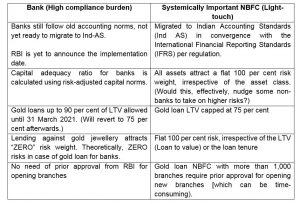

The only material benefit from converting to a bank is the regulatory arbitrage for banks. For example, banks do not need prior approval from RBI for opening new branches while gold loan focused NBFCs with more than 1,000 branches need prior approval for opening new branches. A brief comparison of the regulatory norms applicable to Banks (high compliance requirements) and non-banks (light-touch framework) is given in the table below.

As will be apparent, Banks do have to comply with some extra regulations which do not apply to non-banks, such as SLR, CRR, PSL targets etc. At the same time, there is a perception that banks carry a lower risk compared with non-banks due to low concentration and diversified asset book (lending + investment). There is also a perception that banks have better governance standards than non-banks. However, considering the recent as well as past cases of malfeasance in banks leading to large losses, this may just be a matter of perception.

There is also a feeling that banks, being custodians of public money, have to be strictly regulated compared to non-banking institutions who operate under a light-touch regulatory framework. The RBI has used this term more often to suggest that non-banks are not regulated enough. Therefore, the case that they may pose a systemic risk to the financial system and hence to undergo conversion to a bank over a threshold book size. Whether the threshold should be Rs 50,000 crores or Rs 5,000 crores is a matter of further discussion.

The real question which needs to be addressed is, “What is the objective of RBI in asking non-banks to convert to a bank?” Is it financial stability? If yes, is this the best option? What about financial inclusion? And finally, is it optional or mandatory?

Answering these questions would enable us to address the challenges effectively. There may be tangible benefits for some non-banks in converting to banks but not for all the large NBFCs. The point is not that these non-banks cannot operate as a bank (they certainly can) but that they may not do a good job of it. After all, there is little point in transitioning from an innovative NBFC efficiently serving a niche customer base to a mediocre bank that pleases none.

With best wishes for a happy new year!

Pic Courtesy: google/ images are subject to copyright